- November 4, 2022

- By admin

- Industrial, Projects

SECTOR BRIEF

- Pakistan is the fifth most populous nation on the earth, with 220 million residents, greater than 60 million sturdy labor power, and a rising center class.

- Out of whole inhabitants, 36.38% resides in city areas whereas 63.62 lives in rural elements.

- There’s a rising demand for homes as a consequence of a 2.4% annual inhabitants progress price as per census 2017.

- The nation’s building trade accounts for two.53% of Gross Home Product (GDP) in accordance with the Pakistan Financial Survey. The sector employs 7.61% of the employed Pakistani labour power.

- GFCF in non-public sector grew by 20.6% between FY2019 and FY2020. Non-public sector GFCF amounted over 95% of the whole.

- China Pakistan Financial Hall (CPEC) has given a lift to the development sector by way of the inflow of infrastructural initiatives together with highways, energy crops, and dams.

HIGHLIGHT

- Pakistan is the fifth most populous nation on the earth

- Whole inhabitants, 36.38% resides in city areas whereas 63.62 lives in rural

- GFCF in non-public sector grew by 20.6% between FY2019 and FY2020

- China Pakistan Financial Hall (CPEC) has given a lift to the development sector

REASONS TO INVEST

- Pakistan’s building sector supplies as much as 380 billion PKR in GDP.

- In accordance with the Affiliation of Builders and Builders, pending circumstances pertaining to building and housing add as much as Rs. 1.1 trillion in financial worth.

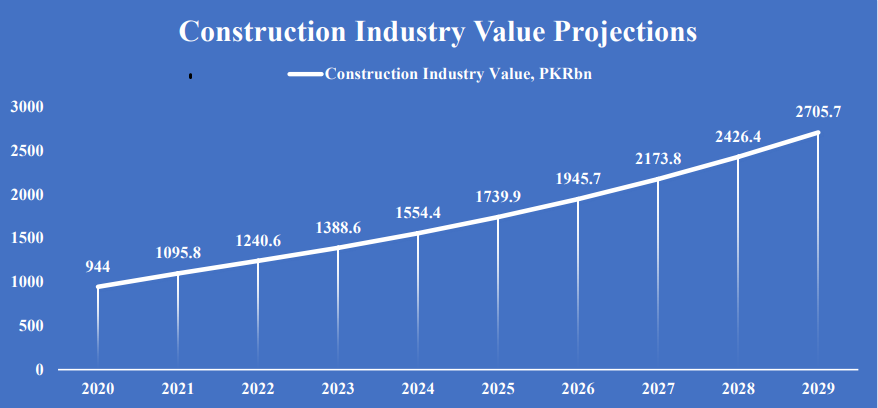

- Fitch Resolution initiatives an trade worth of Rs.2,705.5 billion by 2028 representing the potential of the housing and building trade.

- Development sector has been declared an trade. With this brings tax aid to corporations within the trade by way of the amendments to the tax ordinance. Reforms to tax insurance policies present quite a few incentives to builders and builders in addition to contractors. These embrace decrease tax charges and the elimination of quite a few taxes beforehand hampering the convenience of doing enterprise within the sector.

FOCUS

- Pakistan’s north area has an put in cement capability of 53,722,500 tpa.

- Pakistan’s south area has an put in cement capability of 16,834,600 tpa.

- CPEC and infrastructure initiatives have elevated the demand for metal.

- Pakistan is twenty eighth in metal manufacturing as said in a Pakistan Enterprise Council Report.

- Pakistan ranks at twenty second place worldwide for 263,775 Km size of its highway community.

- First ever Nationwide Transport Coverage has been authorized by GoP in Feb. 2019.

PROJECTED GROWTH

Regardless of decreases in Gross Home Product (GDP), public sector spending on infrastructure, and Overseas Direct Funding (FDI), the outlook stays constructive as a consequence of unprecedented reforms carried out by the federal government by way of restructuring, enchancment in regulatory setting and introduction of incentives and aid packages.

INCENTIVES OFFERED BY THE GOVERNMENT

Development Sector Granted Standing of Business

The Revenue Tax Ordinance has been amended to declare building sector as an industrial enterprise, making it eligible for advantages and concession obtainable to different industries.

New Fastened Tax Regime from Tax Yr 2020 and Onwards for Eligible Builders and Builders

An elective ‘Fastened tax regime’ from tax yr 2020 and onwards for eligible builders and builders has been launched on the revenue, derived from the sale of buildings or sale of plots, from a brand new or an incomplete current challenge. Previous to this, tax was levied on a web revenue foundation. Price and computation of legal responsibility is set beneath rule 10 of the eleventh schedule

Exemption of Withholding Tax on Buy of Constructing Supplies

Eligible Builders and Builders shall be exempted from withholding taxes on buy of constructing supplies. Dividend revenue paid to an individual by a builder or Developer Firm out of the earnings and beneficial properties derived from a challenge shall be exempt from tax and likewise from tax withholding obligations.

Exemption of Capital Good points Tax

Capital beneficial properties acquired by a person on the sale of residential property (private/household) home or flat, have been exempted from revenue tax.

Banks to extend credit score for financing the housing & building sector

With a view to advertise housing and building of buildings (Residential and Non-Residential) in Pakistan, State Financial institution of Pakistan (SBP) has determined to advise necessary targets to the banks. Accordingly, every financial institution shall make sure that the financing for housing and building of buildings (Residential and Non-Residential) shall be not less than 5% of their home non-public sector credit score by December, 2021.

Key Info

- There was a gentle improve within the inbound arrivals and consequently within the inbound receipts. The rise is principally attributed to the drastic enhancements within the authorities‘s effort to offer peaceable and safe setting.

- The lodges & motels trade worth consists of all revenues generated by lodges, motels and different lodging suppliers by way of the supply of lodging and different companies.

- Foodservice is outlined as the worth of all food and drinks, together with on-trade drinks not drunk with meals, for rapid consumption on the premises or in designated consuming areas shared with different foodservice operators, or within the case of takeaway transactions, freshly ready meals for rapid consumption.

- The airways trade contains of passenger air transportation, together with each scheduled and chartered, however excludes air freight transport.